Introduction

Let's discover Open Market OMTrader Platform.

Welcome to the documentation for OMTrader trading platform. This guide is designed to help you understand, navigate, and utilize the platform’s features to their fullest potential. Whether you're a trader, developer, or administrator, our tools offer real-time market access, advanced analytics, and robust automation to support a seamless trading experience.

From account setup to executing complex strategies, this documentation provides clear instructions, best practices, and detailed references to empower your trading journey.

OMTrader Platform Portals

OMTrader trading platform is built with distinct user roles to ensure tailored functionality and streamlined access. Each portal serves a specific purpose, providing tools and controls suited to the user’s role in the trading ecosystem.

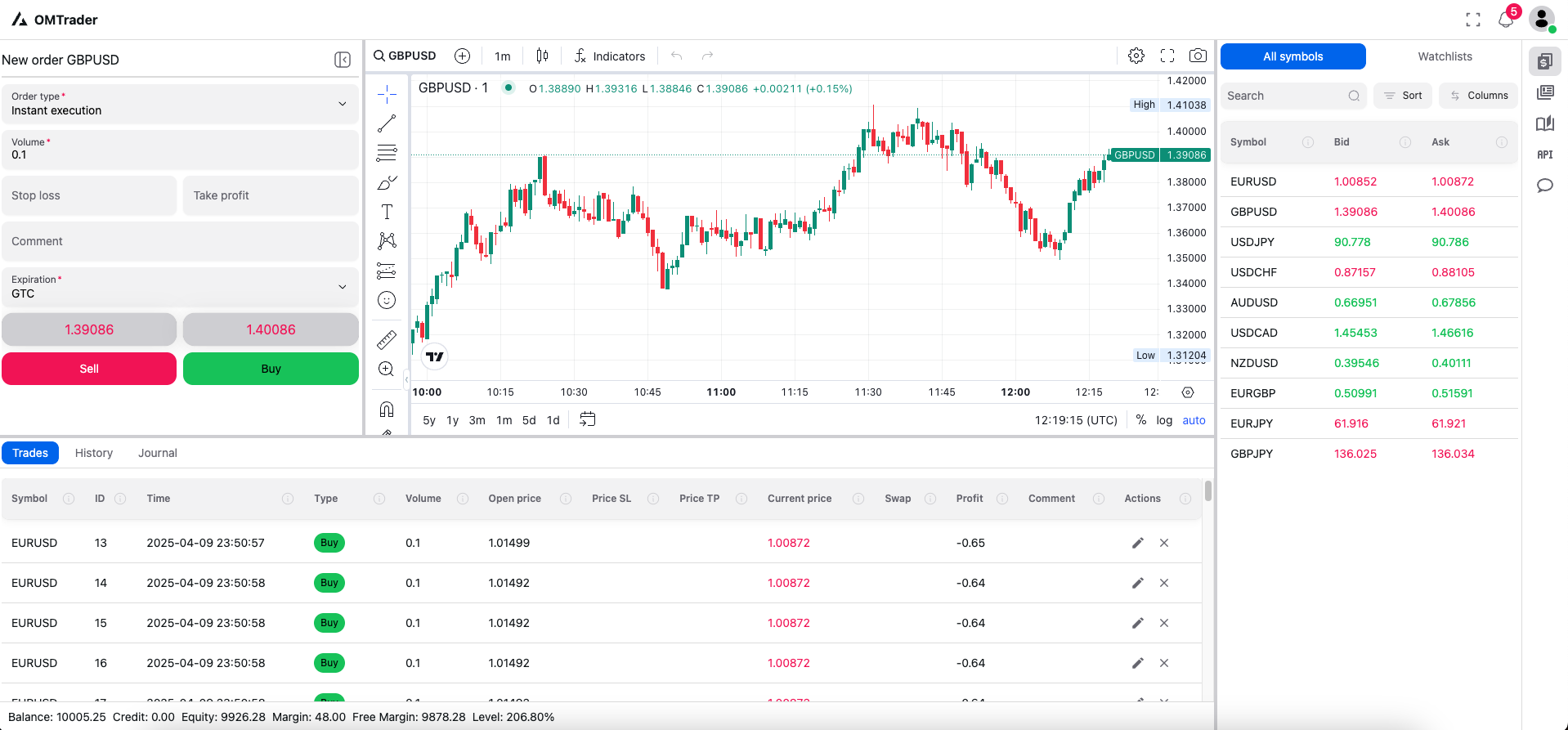

Trader Portal

The Trader Portal is designed for active market participants. It provides real-time market data, intuitive trade execution tools, portfolio tracking, and performance analytics. Traders can place and manage orders, monitor risk, and implement strategies with speed and precision — all from a user-friendly interface.

TradingView™ Integration

OMTrader is officially licensed to integrate charts from TradingView — the industry’s leading charting solution.

By embedding TradingView directly into the OMTrader platform, we provide traders with a rich, intuitive, and professional-grade charting experience, featuring:

-

Real-time price updates

-

Multiple chart types (candlestick, line, area, etc.)

-

Technical indicators and drawing tools

-

Custom timeframes and layouts

-

Watchlist integration

-

Fullscreen mode for detailed analysis

This seamless integration empowers traders with the tools they need to make informed decisions — without ever leaving the OMTrader environment.

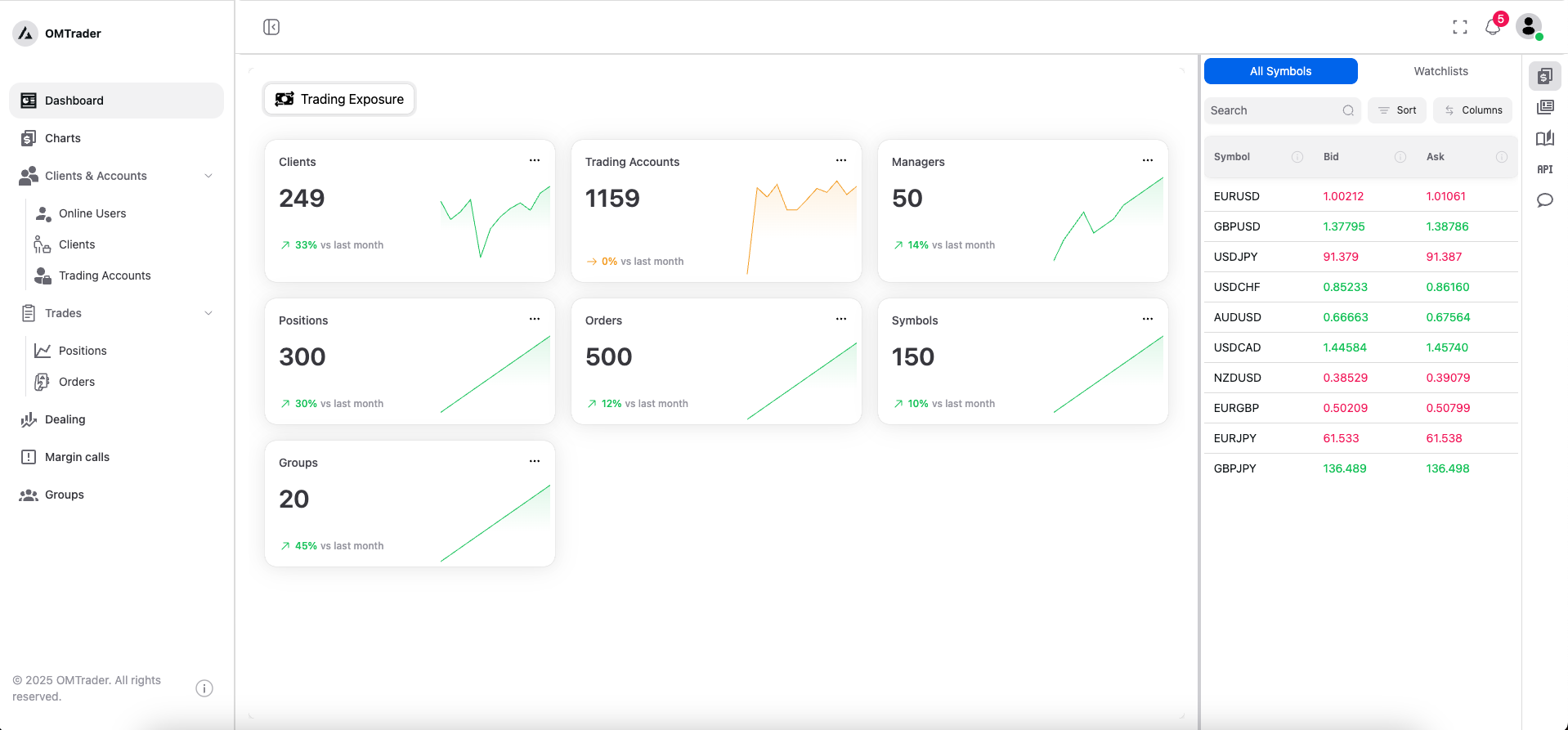

Manager Portal

The Manager Portal is intended for team leads, fund managers, or trading supervisors. It enables oversight across multiple trader accounts, provides aggregated performance reporting, and allows for configuration of trading rules, limits, and approvals. This portal supports efficient team management and ensures compliance with internal policies.

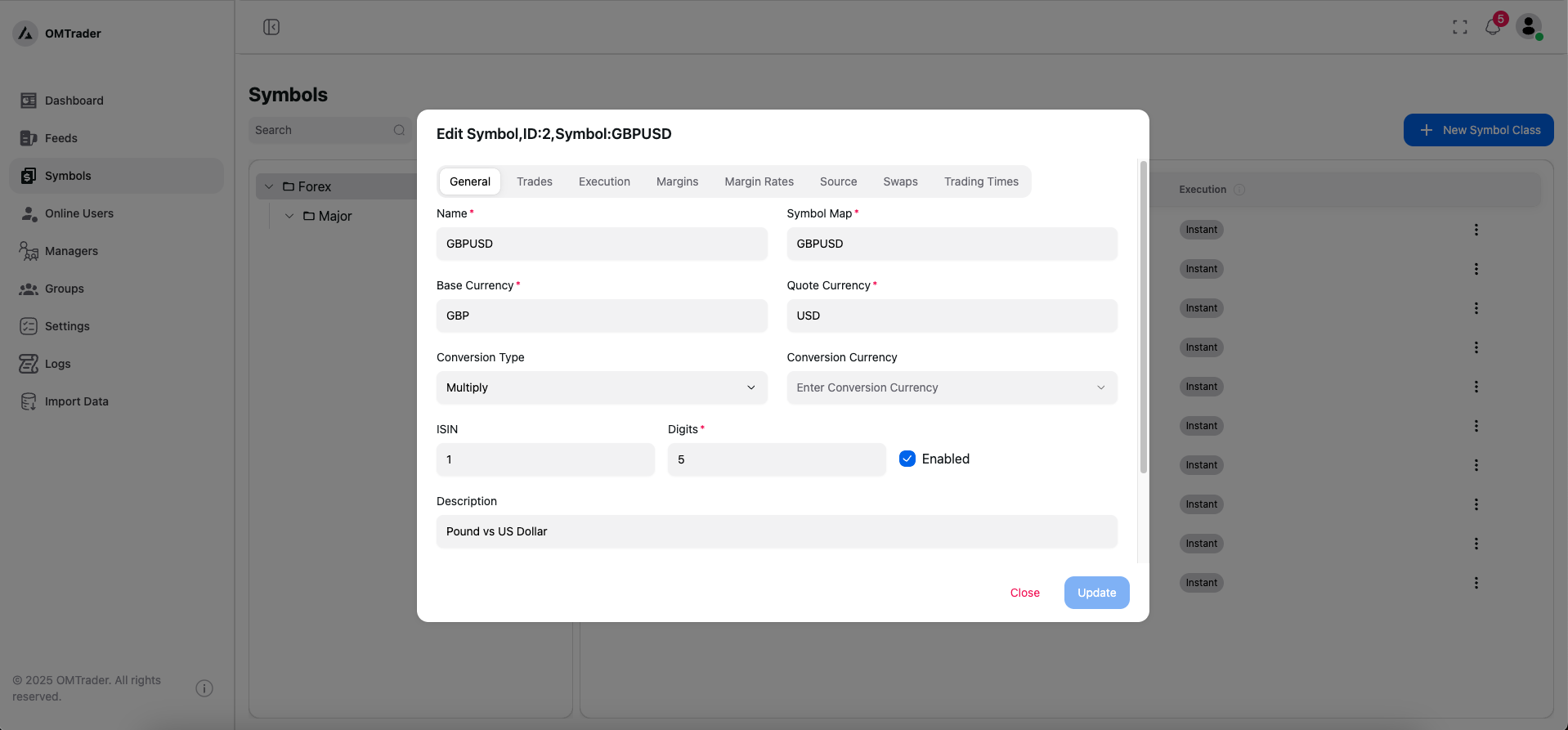

Admin Portal

The Admin Portal offers full control over the platform’s configuration and user management. Admins can create and manage user accounts, assign roles, configure system settings, monitor activity logs, and enforce platform-wide rules. This portal ensures the security, integrity, and smooth operation of the entire trading system.

Technology Overview

Our trading platform is built on a modern microservices architecture, designed for scalability, flexibility, and high performance. This approach allows us to develop, deploy, and manage each core function of the platform as an independent service — enabling rapid innovation and robust system reliability.

Technology Stack

-

Service Independence: Each component — such as order execution, account management, risk control, and analytics — operates as a standalone service. This enables targeted updates without impacting the entire system.

-

Scalability: Services can scale individually based on demand. For example, market data and trade execution services can auto-scale during peak trading hours without affecting the rest of the platform.

-

Resilience & Fault Isolation: If one service fails, it doesn’t bring down the entire system. Fault isolation and retry logic help maintain platform stability.

-

Technology Flexibility: Each service can be built using the most appropriate tools and languages for its purpose. This supports faster development cycles and better performance optimization.

-

API-Driven Communication: Services communicate over lightweight APIs, often REST or gRPC, ensuring efficient and secure data flow across the platform.

-

Containerization & Orchestration: The platform leverages container technologies (e.g., Docker) and orchestration tools (e.g., Kubernetes) to manage deployment, scaling, and service discovery in dynamic cloud environments.

-

Event-Driven & Real-Time Capabilities: Using message queues or event buses, the system supports real-time updates and asynchronous processing — essential for a responsive trading experience.

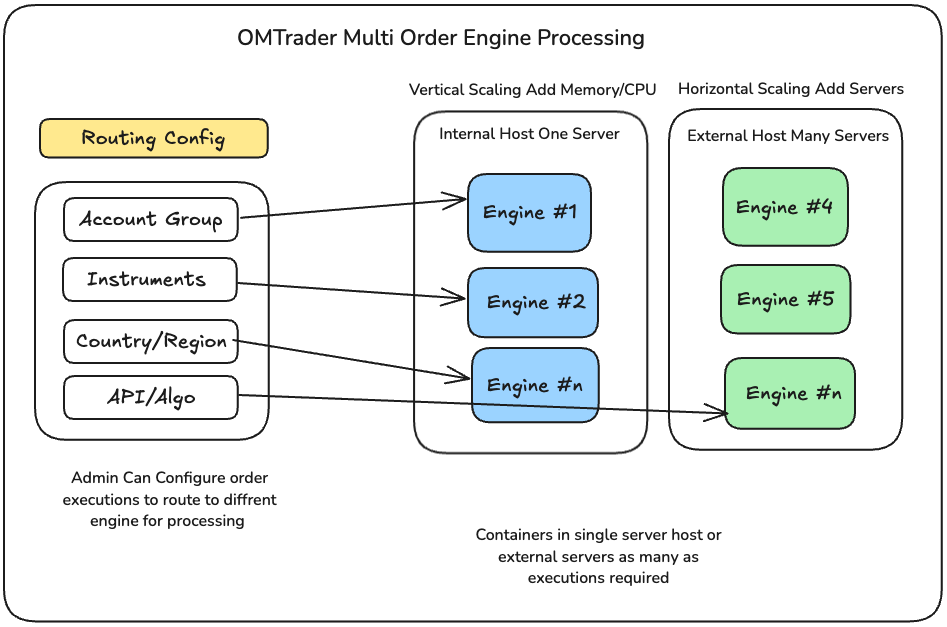

Multi Order Execution Engines

Our platform supports a multi-engine architecture for order execution, designed to ensure flexibility, speed, and reliability across diverse trading environments. By decoupling execution logic into specialized engines, we can optimize for different asset classes, market conditions, and execution strategies.

Overview

Each order execution engine is responsible for processing and routing trades according to defined rules and connectivity. The system supports dynamic selection of execution engines based on user configuration, asset type, and order strategy.

Key Features

-

Engine Diversity: Multiple execution engines operate in parallel, each tailored for specific use cases such as:

-

Direct Market Access (DMA): For low-latency, high-speed trading directly with exchanges.

-

Smart Order Routing (SOR): For optimizing order flow across multiple venues to achieve best execution.

-

Simulated/Testing Engine: For backtesting or paper trading in a safe, non-production environment.

-

Algo Execution Engine: For running custom algorithmic strategies like TWAP, VWAP, or iceberg orders.

-

Dynamic Routing: Orders can be routed to different engines based on:

Trader configuration

-

Asset class (e.g., equities, crypto, forex) , based on Data-Feed provider

-

Market condition or availability time of qoutes & trading

-

Account type or order size

Resilient Design

In high-performance trading systems, resilience is not optional — it’s essential. Our platform is built with a resilience-first approach, ensuring uninterrupted service, graceful degradation, and rapid recovery from failures. This design philosophy minimizes downtime, protects against cascading failures, and maintains trust in fast-paced, high-stakes trading environments.

-

High Availability: The architecture ensures redundancy and failover capability. If one engine becomes unresponsive, the system can reroute to a backup or alternate engine.

-

Pluggable Design: New execution engines can be integrated with minimal disruption, enabling the platform to expand its reach into new markets and trading models.

-

Monitoring & Logging: Every engine is monitored independently, and detailed execution logs are maintained for transparency, compliance, and debugging.

- Fault Isolation Each component in the platform is deployed as an independent microservice. If one service fails (e.g., market data feed), it is isolated from the rest of the system to prevent a total platform outage. Isolation is enforced using:

Circuit breakers

Timeouts

Bulkheads (resource containment per service)

-

Failover & Redundancy Redundant instances of critical services (e.g., order execution engines, authentication, market connectivity) are always running. If a primary instance fails, traffic is automatically rerouted to a standby instance with minimal impact.

-

Retry & Backoff Mechanisms Transient failures — such as brief network outages or service timeouts — are handled through smart retry logic with exponential backoff. This prevents overloading downstream systems while still attempting recovery.

-

Graceful Degradation When a non-critical system component (e.g., analytics or notifications) becomes unavailable, the platform continues to operate in a degraded mode. Users may experience limited functionality, but core trading capabilities remain intact.

-

Monitoring & Health Checks Real-time health checks and telemetry are integrated across all services. Monitoring systems track:

Service availability

Latency

Error rates

Resource usage

Alerts are triggered proactively to operations teams for rapid intervention.

-

Self-Healing Capabilities Automated workflows (via Kubernetes or equivalent orchestrators) detect unhealthy service instances and restart them without manual intervention, ensuring sustained service availability.

-

Disaster Recovery & Data Integrity Geo-Redundant Backups: All critical data is backed up and replicated across multiple regions to prevent data loss.

Automated Recovery Plans: Well-tested runbooks and recovery scripts are in place to restore services quickly in the event of regional outages or severe system disruptions